How Much Mortgage Can I Afford? This crucial question weighs heavily on the minds of prospective homeowners. Navigating the complexities of mortgage financing requires a clear understanding of income, expenses, interest rates, and various associated costs. This guide unravels the intricacies of determining your maximum affordable mortgage, empowering you to make informed decisions throughout the home-buying process.

From analyzing your debt-to-income ratio and crafting a realistic budget to exploring different loan terms and understanding closing costs, we provide a comprehensive framework. We’ll also examine the role of property taxes, homeowners insurance, and the importance of consulting with a mortgage professional. By the end, you’ll possess a clearer picture of your financial capacity and be better equipped to embark on your homeownership journey.

Understanding Your Income and Expenses: How Much Mortgage Can I Afford

Determining how much mortgage you can afford begins with a thorough assessment of your income and expenses. This involves more than just looking at your monthly take-home pay; it requires a comprehensive understanding of your financial situation to ensure long-term financial stability.

Factors Influencing Mortgage Affordability Based on Income

Your gross monthly income (before taxes and deductions) is the primary factor lenders consider. However, they also examine your net monthly income (after taxes and deductions) to determine your actual disposable income. Other factors include the stability of your income (consistent employment history is crucial), and any additional income streams, such as rental income or investment returns.

Debt-to-Income Ratio (DTI) in Mortgage Qualification

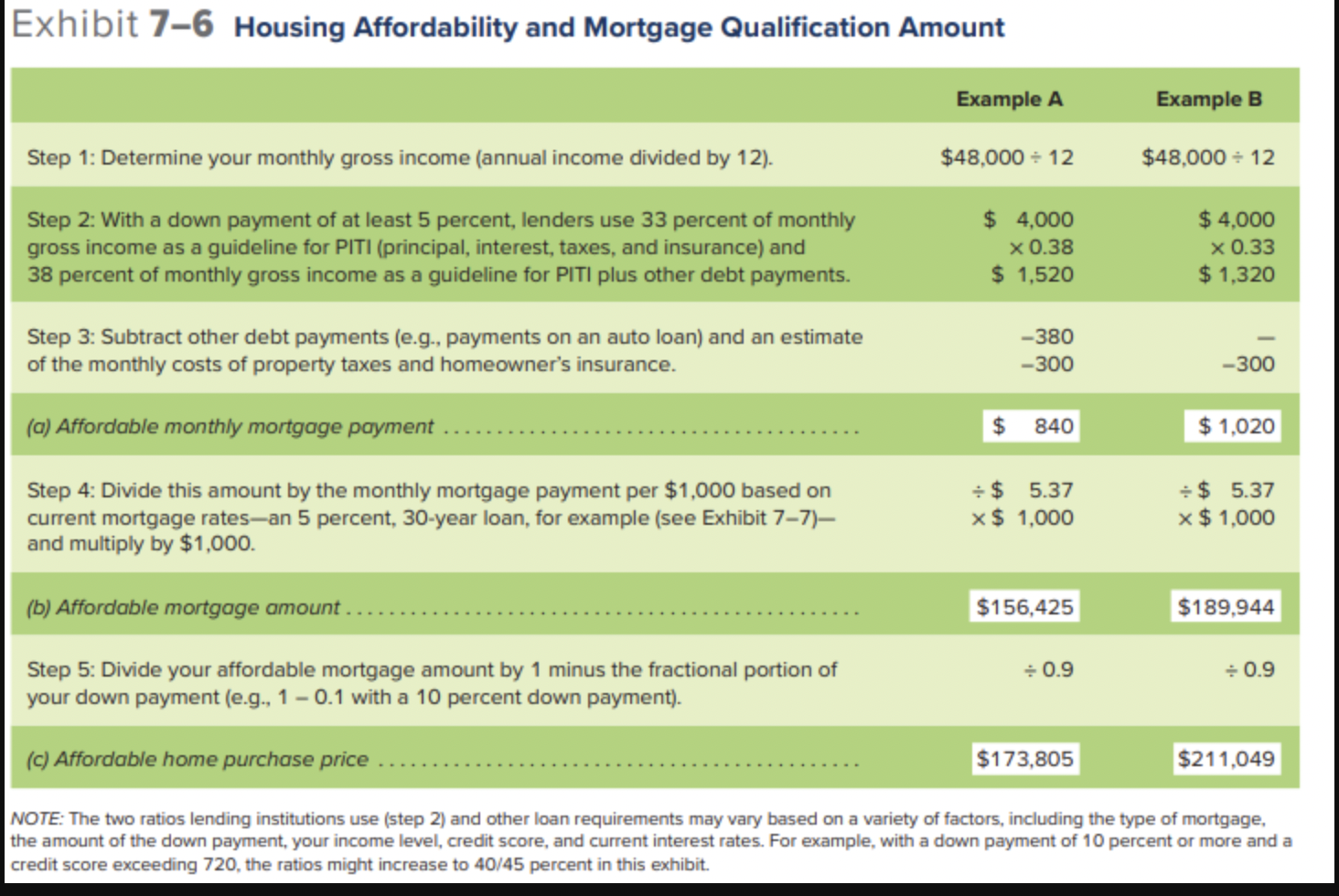

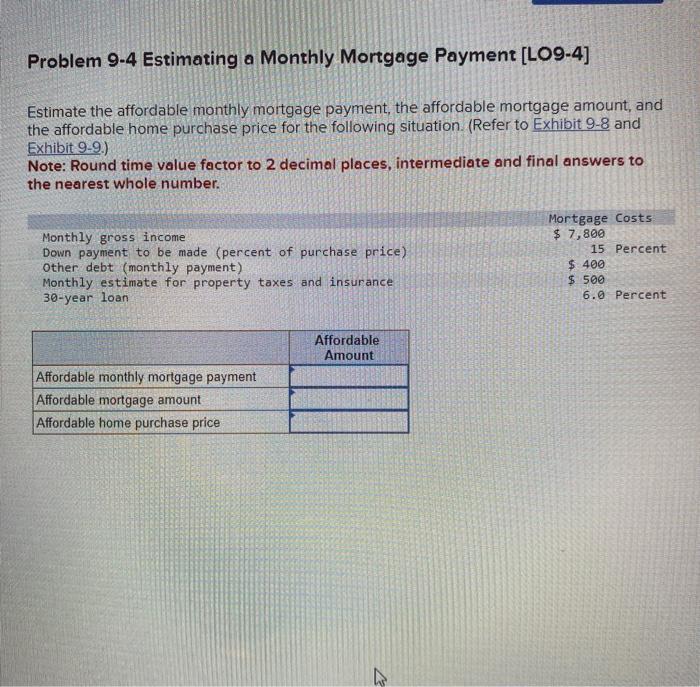

Your debt-to-income ratio (DTI) is a crucial metric lenders use to assess your risk. DTI is calculated by dividing your total monthly debt payments (including the proposed mortgage payment) by your gross monthly income. A lower DTI indicates a lower risk to the lender, increasing your chances of mortgage approval and potentially securing a better interest rate. Lenders generally prefer a DTI below 43%, although this can vary.

Sample Budget Showing How Different Expenses Affect Mortgage Affordability

Source: cheggcdn.com

A realistic budget is essential. It should include all your monthly expenses, such as housing, transportation, food, utilities, debt payments, and entertainment. By subtracting these expenses from your net income, you can determine how much you have left for a mortgage payment.

| Expense Category | High-Income, Low-Expense | Low-Income, High-Expense |

|---|---|---|

| Gross Monthly Income | $10,000 | $4,000 |

| Net Monthly Income | $7,500 | $2,800 |

| Total Monthly Expenses (excluding mortgage) | $2,000 | $2,500 |

| Remaining Income for Mortgage | $5,500 | $300 |

Comparison of High-Income, Low-Expense vs. Low-Income, High-Expense Scenarios

| Scenario | Maximum Mortgage Amount (Estimate) | DTI | Notes |

|---|---|---|---|

| High Income, Low Expenses | $800,000 – $1,000,000 | <30% | Significant borrowing power due to high income and low expenses. |

| Low Income, High Expenses | $50,000 – $75,000 (or potentially ineligible) | >43% | Limited borrowing power due to low income and high expenses; may require a very small mortgage or be ineligible. |

Exploring Interest Rates and Loan Terms

Understanding interest rates and loan terms is critical to determining your monthly mortgage payment and overall affordability. Different interest rates and loan terms significantly impact the total cost of the loan and your monthly financial commitment.

Impact of Different Interest Rates on Monthly Mortgage Payments

Source: cheggcdn.com

A higher interest rate results in a higher monthly payment for the same loan amount. For example, a $300,000 mortgage at a 4% interest rate will have a lower monthly payment than the same mortgage at a 7% interest rate. Even small changes in interest rates can substantially affect the affordability of a mortgage.

Effect of Varying Loan Terms on Affordability, How Much Mortgage Can I Afford

A 15-year mortgage has higher monthly payments than a 30-year mortgage for the same loan amount and interest rate. However, you’ll pay significantly less interest over the life of the 15-year loan. Choosing a shorter term means paying more upfront but saving money in the long run. A longer term means lower monthly payments but higher overall interest paid.

Comparison of Fixed-Rate and Adjustable-Rate Mortgages (ARMs)

Fixed-rate mortgages offer predictable monthly payments for the life of the loan. Adjustable-rate mortgages (ARMs) have an initial fixed interest rate that adjusts periodically based on market conditions. ARMs may offer lower initial payments but carry the risk of significantly higher payments in the future if interest rates rise.

Monthly Payments for Different Loan Amounts, Interest Rates, and Loan Terms

| Loan Amount | Interest Rate | Loan Term (Years) | Estimated Monthly Payment |

|---|---|---|---|

| $250,000 | 4% | 30 | $1,193 |

| $250,000 | 6% | 30 | $1,500 |

| $250,000 | 4% | 15 | $1,800 |

| $350,000 | 5% | 30 | $1,870 |

Property Taxes and Homeowners Insurance

Property taxes and homeowners insurance are significant recurring expenses associated with homeownership. These costs, often paid monthly as part of your mortgage payment (through an escrow account), directly impact your overall housing affordability.

Determining how much mortgage you can afford involves careful consideration of income, debt, and savings. Understanding your financial capacity is crucial, and sometimes, the dedication required mirrors the intensity described in a Passion Crossword Clue , demanding a similar level of focus and commitment. Ultimately, responsible homeownership hinges on a realistic assessment of your financial situation to avoid future strain.

How Property Taxes and Homeowners Insurance Affect Total Monthly Housing Cost

Property taxes are levied annually by local governments and vary widely based on property value and location. Homeowners insurance protects your property from damage and liability. Both are typically included in your monthly mortgage payment, increasing your total housing cost.

Variations in Property Taxes and Insurance Premiums Across Locations

Property tax rates and insurance premiums differ significantly across geographic areas. Some regions have higher property values, leading to higher property taxes. Similarly, areas prone to natural disasters (e.g., hurricanes, earthquakes) tend to have higher homeowners insurance premiums.

Estimating Annual Property Taxes and Homeowners Insurance Costs

You can estimate annual property taxes by contacting your local tax assessor’s office or using online property tax calculators. Homeowners insurance costs can be estimated using online comparison tools or by contacting several insurance providers for quotes.

Factors Affecting Property Taxes and Insurance

- Property value

- Location

- Property type and size

- Insurance coverage level

- Risk factors (e.g., proximity to fire hazards, flood zones)

Summary

Determining how much mortgage you can afford is a multifaceted process, demanding careful consideration of various financial factors. While online calculators offer a starting point, personalized guidance from a mortgage professional is invaluable. By meticulously assessing your income, expenses, and long-term financial goals, you can confidently determine a mortgage amount that aligns with your financial stability and ensures a comfortable and sustainable homeownership experience.

Remember, responsible homeownership begins with a realistic understanding of your financial capabilities.