GME short interest Ortex data has become a focal point for market analysts and retail investors alike. Understanding how Ortex calculates short interest, its limitations, and the correlation (or lack thereof) between reported short interest and GME’s stock price is crucial for navigating the complexities of this volatile stock. This analysis delves into Ortex’s methodology, compares its data with other sources, and explores the contextual factors influencing short interest figures, ultimately aiming to provide a nuanced perspective on interpreting this often-misunderstood metric.

The analysis will cover historical short interest trends, key metrics like “short interest as a percent of float” and “days to cover,” and the potential impact of regulatory changes and institutional investor behavior. We will also examine potential misinterpretations of Ortex data and emphasize the importance of considering multiple data sources for a comprehensive understanding of GME’s short selling landscape.

Ortex Short Interest Data on GME: An In-Depth Analysis

Ortex provides a widely followed, albeit controversial, source of short interest data. This analysis delves into Ortex’s methodology, limitations, and the correlation between its reported GME short interest and the stock’s price movements. We will also examine potential misinterpretations and the importance of considering multiple data sources for a comprehensive understanding.

Monitoring GME short interest via Ortex reveals fluctuating data, prompting speculation amongst investors. This volatility underscores the unpredictable nature of the market, leading some to consider alternative lifestyles, as showcased in the insightful off grid living show , a testament to the desire for financial independence. Ultimately, understanding GME short interest remains crucial for navigating the market’s complexities.

Ortex Data Overview, Gme short interest ortex

Ortex calculates short interest by aggregating data from various sources, including brokerages and other market participants. Their methodology relies on a combination of reported and inferred short positions. However, this approach has limitations. Not all short positions are reported, leading to potential underestimation. Furthermore, the data is subject to delays and potential biases stemming from the self-reporting nature of the data sources.

Ortex’s figures often differ from those reported by other sources like the exchanges or financial analytics firms, primarily due to variations in data collection and calculation methodologies. Historically, Ortex’s reported GME short interest has exhibited significant fluctuations, reflecting the stock’s volatile nature and the intense interest surrounding its short squeeze potential. These fluctuations have often been linked to news events, social media sentiment, and options trading activity.

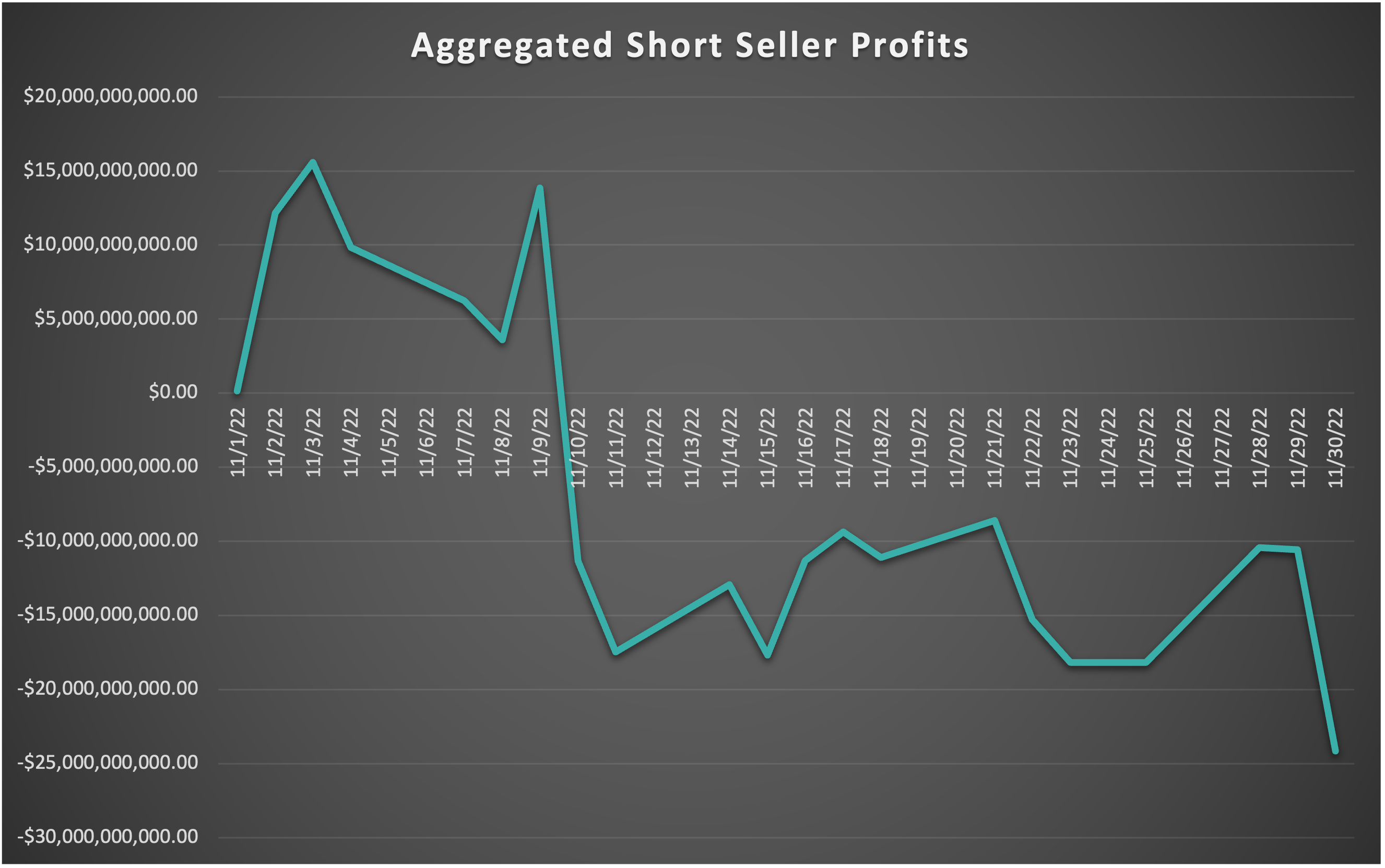

Short Interest and Stock Price Correlation

Source: ortex.com

The relationship between Ortex’s reported GME short interest and its stock price is complex and not always straightforward. While periods of high short interest have sometimes coincided with significant price increases (as seen during the January 2021 short squeeze), there have also been instances where the correlation was weak or even inverse. Market sentiment, news events (such as regulatory announcements or financial reports), and options trading activity all play a significant role in influencing this relationship.

The intense retail investor involvement in GME adds another layer of complexity, making simple correlation analysis insufficient for explaining price movements.

| Date | Ortex Short Interest (%) | GME Stock Price ($) | Notable Events |

|---|---|---|---|

| January 26, 2021 | High (Illustrative Data) | 347.50 (Illustrative Data) | Peak of short squeeze |

| March 10, 2021 | Lower (Illustrative Data) | 50.00 (Illustrative Data) | Post-squeeze decline |

| June 1, 2021 | Moderate (Illustrative Data) | 185.00 (Illustrative Data) | Price recovery |

(Note: Illustrative data used for demonstration. Actual figures would need to be sourced from Ortex and reputable financial data providers.)

Interpreting Ortex’s Short Interest Metrics

Ortex’s “short interest as a percent of float” metric indicates the proportion of the available shares that are shorted. A high percentage suggests significant short selling activity. The “days to cover” metric estimates the time it would take for short sellers to buy back all shorted shares at the current trading volume. A high “days to cover” value can indicate potential for a short squeeze.

Ortex’s data can influence investor behavior, with high short interest potentially encouraging short squeezes driven by retail investors. High days to cover can amplify this effect.

Visualization Description: A line chart showing the Ortex reported short interest percentage of float and days to cover for GME over time. Both metrics would be plotted on the same chart with different y-axes, allowing for visual comparison of their trends and correlation. Key dates, like significant price movements or news events, could be highlighted on the chart for added context.

Contextual Factors Affecting Short Interest

Several factors beyond Ortex’s data influence GME’s short interest. Regulatory changes impacting short selling practices can affect reported figures. Comparing GME’s short interest to similarly situated companies helps contextualize the data, revealing whether the level is unusually high or in line with industry norms. Institutional investors’ trading activities significantly impact short interest, while retail investor participation adds complexity. Different short-selling strategies, such as short covering, naked short selling, and synthetic short selling, can influence Ortex’s reported figures.

- Short Covering: Closing out short positions by buying back the borrowed shares.

- Naked Short Selling: Selling shares without borrowing them, a practice often considered risky and potentially illegal.

- Synthetic Short Selling: Achieving a short position through options strategies, rather than directly borrowing and selling shares.

Potential Misinterpretations of Ortex Data

Relying solely on Ortex data for understanding GME’s short interest can lead to inaccuracies and misinterpretations. Other data sources, such as exchange reports and financial news, should be consulted for a more comprehensive picture. Making investment decisions based solely on Ortex’s figures is risky, as the data is subject to limitations and potential biases.

“The Ortex data, while informative, should not be the sole basis for investment decisions. Consider the context, limitations, and other market factors before drawing conclusions.”

“Interpreting a high short interest as an automatic signal for a short squeeze can be misleading. Other factors, such as market sentiment and overall trading volume, are crucial to consider.”

Last Point: Gme Short Interest Ortex

While Ortex data provides valuable insights into GME’s short interest, it’s crucial to remember that it’s just one piece of the puzzle. Investors should approach this data with caution, acknowledging its limitations and potential biases. A holistic understanding requires incorporating other data sources, considering market sentiment, and acknowledging the multifaceted nature of short selling strategies. Relying solely on Ortex data for investment decisions carries significant risk, highlighting the need for a comprehensive and nuanced approach to market analysis.